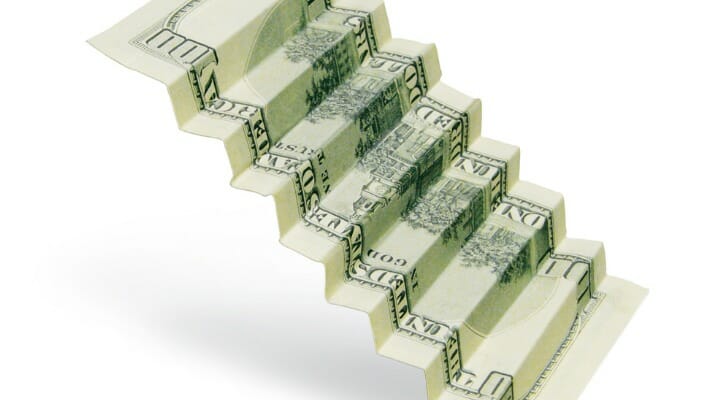

How to Invest in Cds So That You Dont Have to Work Again

Looking at interest rates for certificates of deposit (CD), you lot come across that the v-yr CD earns, say, 2% more than the i-year CD. You'd love to go that higher charge per unit, just you're worried about locking up your money for so long. The solution: a CD ladder, where you divvy your money into several CDs with staggered term lengths. That fashion, some of your money will go the higher charge per unit and some of your money is not locked up for v years. Every bit each CD matures, y'all renew it for the longest term in your ladder, again snagging the highest interest rate but nevertheless having the liquidity of the adjacent CD set up to mature. Read on for the pros and cons of this savings strategy.

How CD Ladders Work

When you purchase a CD, the money is held in your account until it reaches its maturity date. At the finish of the term, you lot accept admission to your original investment plus the interest it earned. Typically, CDs offer a improve rate than a savings business relationship, which is the reason for parking your savings in a CD. It'due south a pretty clear-cut decision. The complication is choosing the term length.

Typically, involvement rates get upwards with term lengths, e.g., a five-year CD offers a higher rate than a 1-twelvemonth CD. No doubt, yous want the higher rate. The problem is that information technology may not exist smart to lock up your money for then long. You might need the money. Also, rates might rise even more while y'all are locked into your rate for years.

This is where a CD ladder is useful. Every bit noted to a higher place, to build i, you buy multiple CDs with staggered maturity dates. This gives y'all a range of interest rates and term lengths. As each CD matures, you renew it for the longest term in social club to get the highest interest rate. For example, y'all buy one-year, two-year, three-year, 4-year and five-twelvemonth CDs, earning 1%, one.25%, 1.5%, 2.0% and 3.v%, respectively. When the ane-twelvemonth CD matures, y'all renew it for five years at 3.v%. So now, your 5 CDs are earning 1.25%, ane.5%, 2.0%, 3.5% and 3.5%. After three more than years (and renewals), all your CDs will be earning iii.five% (assuming involvement rates stay the same), with one CD maturing every year.

CD Ladder Benefits

Using a CD ladder to grow your savings works to your reward in 2 ways. Commencement, it offers yous more liquidity (quicker admission to your cash) than if you were to lock all of your money into a single CD. In one case you set up up a CD, you tin can't withdraw any money before the maturity date without paying a penalty. With a CD ladder, the next maturity engagement could be correct around the corner then if an emergency comes upward, you lot can go your hands on some cash penalty-free.

At the same time that you have more than liquidity, you are earning college interest rates on more and more of your coin. Theoretically, by the fourth dimension you take cycled through and renewed the penultimate CD, all of your CDs will be earning the highest interest rate bachelor at the time of renewal. They'll be doing this – without all of your coin being locked up for five years or however-long-is-the-longest-term in your ladder.

CD Ladder Drawbacks

CD ladders make sense when interest rates ascent in tandem with term lengths. They besides make perfect sense if involvement rates are holding steady. Merely if interest rates flip so that they are higher for shorter CDs, y'all wouldn't want to be stuck in a long ladder. Same goes if interest rates are ascension.

On the other hand, if interest rates are falling, y'all would be glad to be in a ladder where some of your coin is locked in for many years. At to the lowest degree, that'due south the glass-half-full perspective. People who see the drinking glass one-half empty would think information technology a mistake that all of their coin isn't locked in.

Which is all to say that CD ladders are a hedge. They may or may not maximize your earnings. But they volition keep some of your money liquid.

Shop Around for the Best Rates

If you lot're set on laddering CDs, checking out what unlike banks are offering is a must. Online banks in particular tend to offer college rates considering they generally have lower overhead costs than brick-and-mortar banks. When edifice your CD ladder, remember that CDs accept relatively low rates of return and manage your expectations accordingly.

Tips for Investing

- If yous don't have a lot to invest, consider signing up a robo-advisor. Generally, these automated investing platforms offer lower fees and require smaller account minimums than traditional financial advisors.

- Yet, if yous prefer the human touch and talking face-to-face, consider working with a traditional fiscal counselor. SmartAssset's matching tool will recommend upwards to three, based on your needs and preferences. Information technology's free and takes five minutes.

Photo credit: ©iStock.com/Yuri, ©iStock.com/halfbottle, ©iStock.com/Leonardo Patrizi

Source: https://smartasset.com/investing/the-pros-and-cons-of-using-a-cd-ladder-to-build-savings

0 Response to "How to Invest in Cds So That You Dont Have to Work Again"

Post a Comment